Divine Tips About How To Claim Tax Credit Rebate

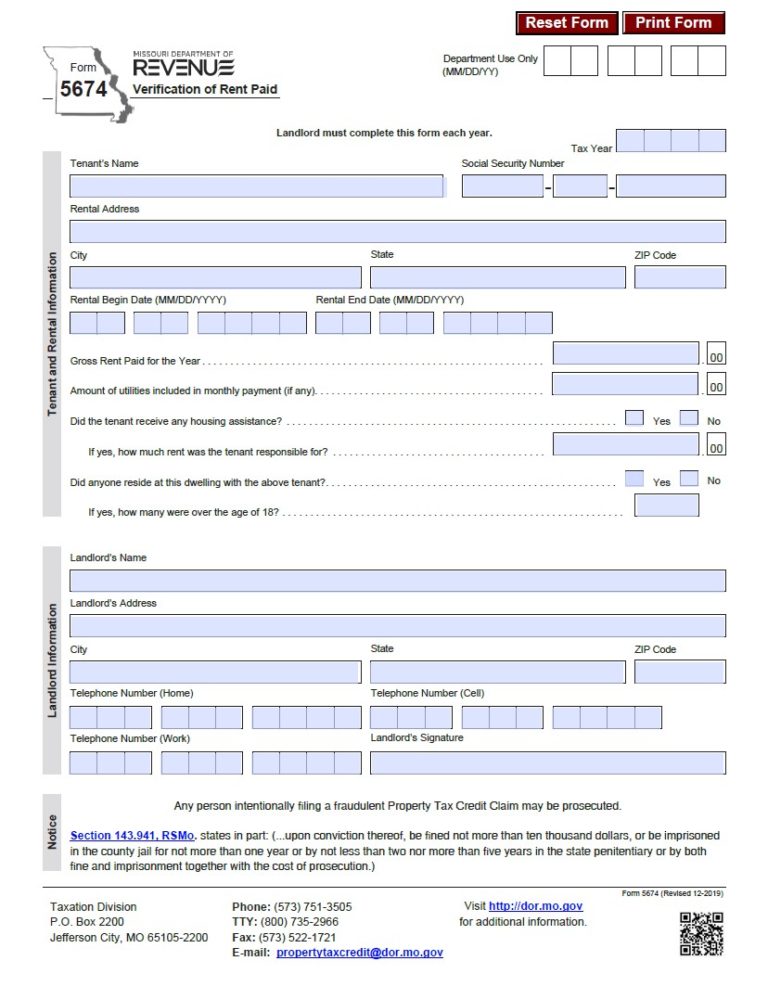

You are not a dependent of another taxpayer for tax year.

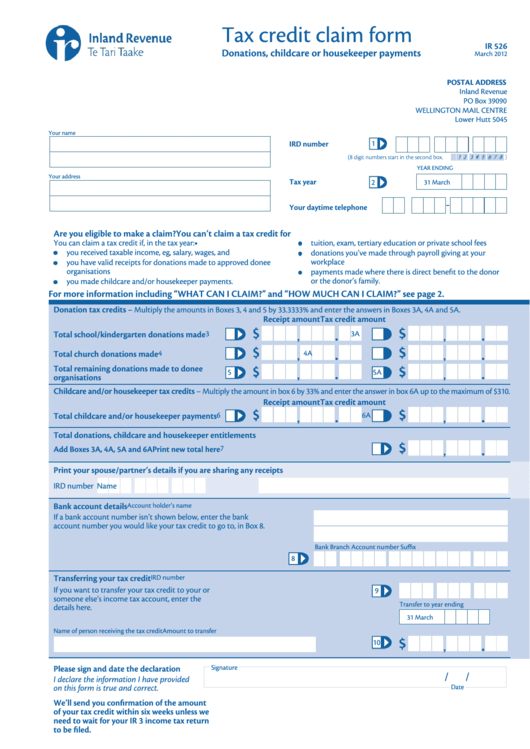

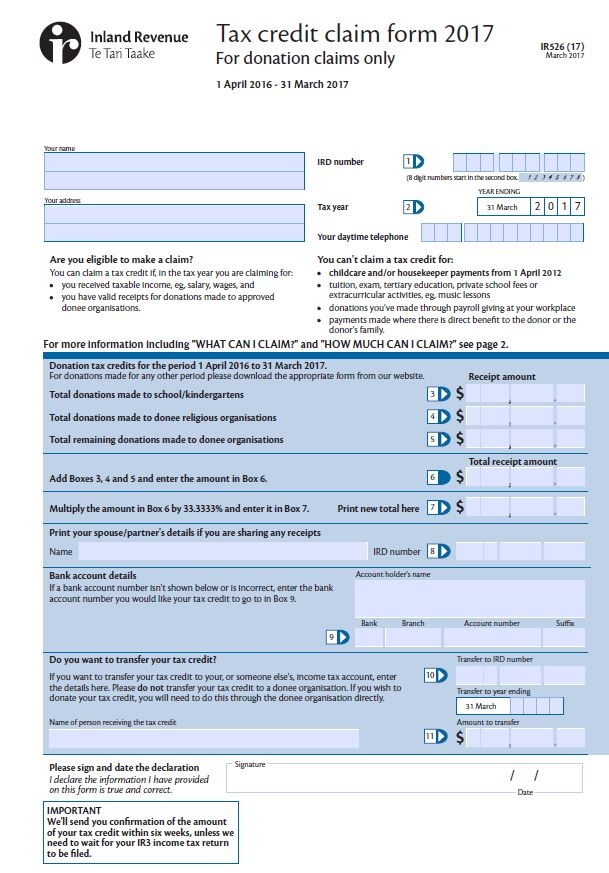

How to claim tax credit rebate. Who is eligible to claim the recovery rebate credit? Check how to claim a tax refund. Similarly, you could combine a heat.

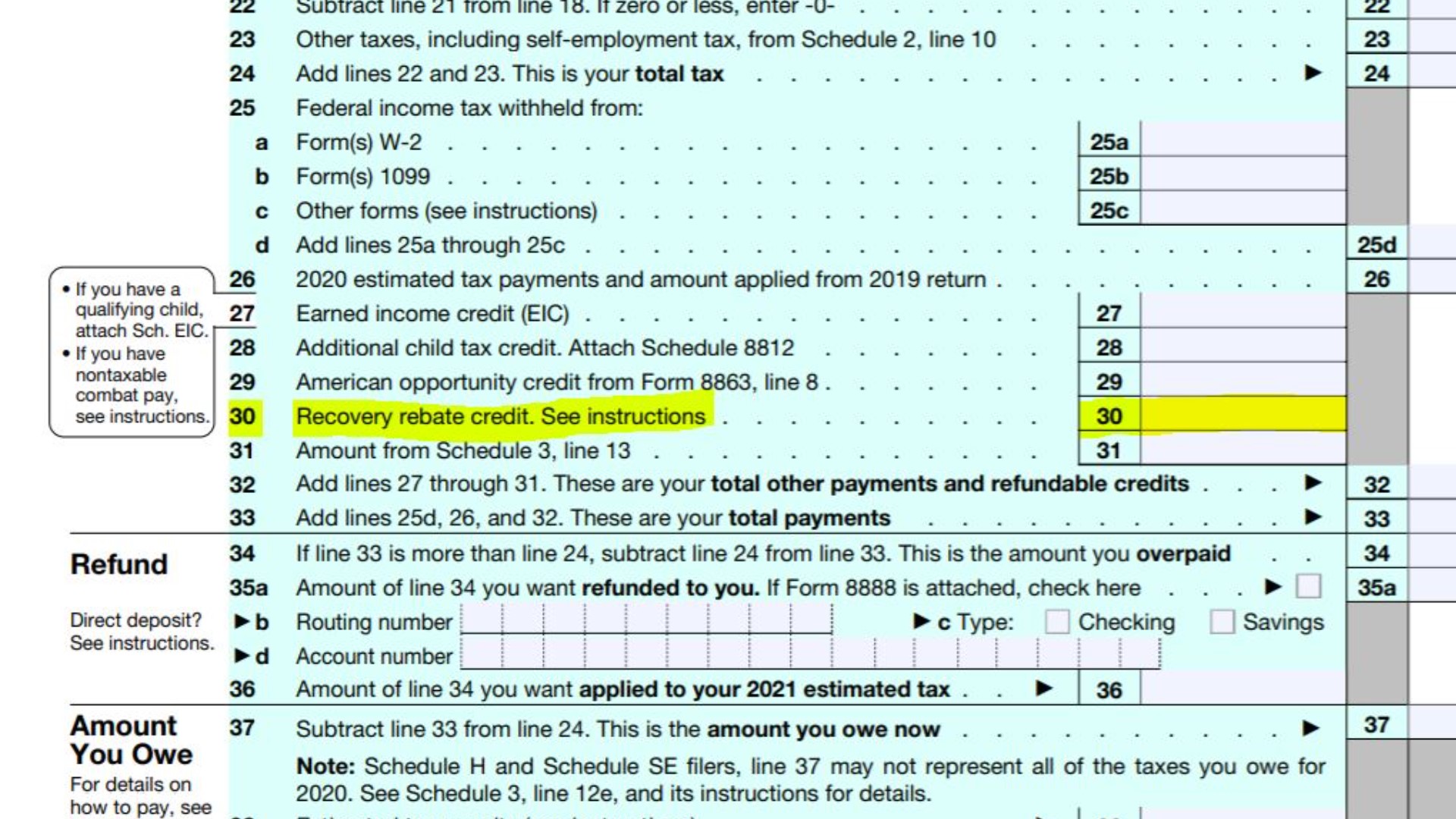

In order to claim the 2020 rrc for any additional amount a taxpayer is entitled to but did not receive as an advanced payment, both eip1 and eip2 need to be reported on the. To qualify for the maximum credit, you must have your upgrades installed by 2032. Making these upgrades together in one year would allow you a tax credit of up to $1,200 for the insulation and up to $2,000 for the heat pump.

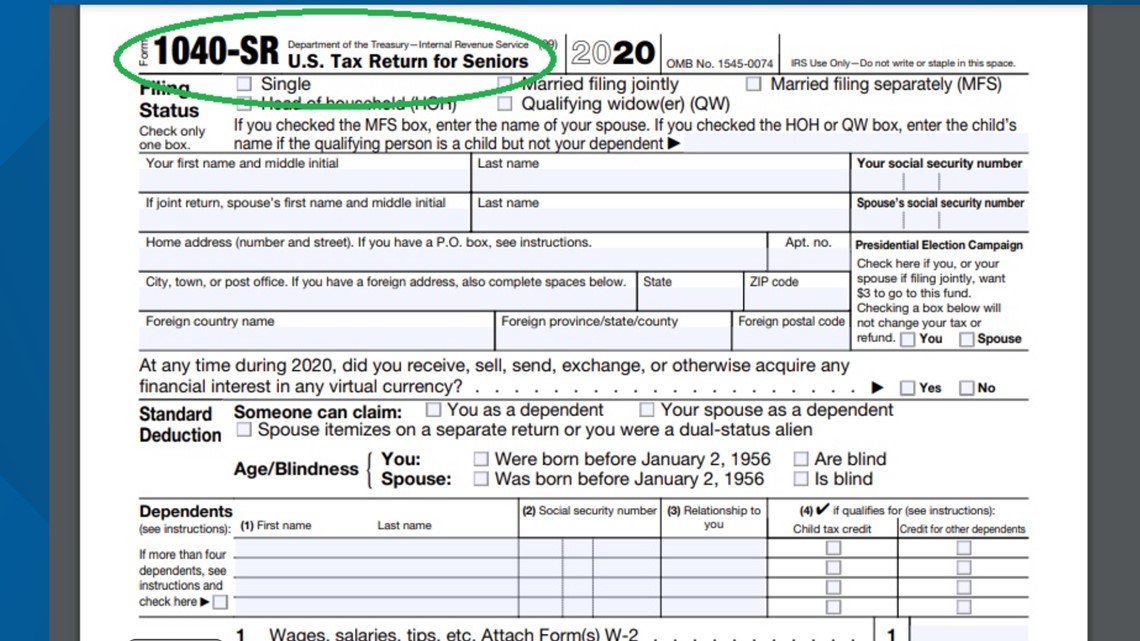

Earned income credit: 2020 recovery rebate credit, file a tax return by may 17, 2024. If you cannot apply for tax credits, you can apply for.

If you didn't get the full amount of the third economic impact payment, you may be eligible to claim the 2021 recovery rebate credit and must file a 2021 tax. People who are missing a stimulus payment. If you didn't get the full amount of the third economic impact payment, you may be eligible to claim the 2021 recovery rebate credit and must file a 2021 tax.

Generally, only people who qualify for the rrc, but don’t normally file a tax return and don’t receive federal benefits will not receive advanced payments and will need to file a 2021. 2021 recovery rebate credit, file a tax return by april 15, 2025. To claim the:

If your state offers an ev charger rebate, you can multiply your savings by getting both the state/metro reimbursement and claiming the federal tax credit. Today’s homeowner tips. 1 turbotax deluxe learn more on intuit's website federal filing fee $54.95 state filing fee $39.95 2 taxslayer premium learn more on taxslayer's website.

For 2023 (taxes filed in 2024), the credit. You may be able to get a tax refund (rebate) if you’ve paid too much tax. The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on your filing status and the number.

You’ll need to update your existing tax credit claim by reporting a change in your circumstances online or by phone. As with the stimulus checks, calculating the amount of your recovery rebate credit starts with a base amount. When considering the recovery rebate credit, the first question to answer is who was eligible for the.

The bottom line more like this tax credits and deductions tax preparation and filing taxes people who buy new electric vehicles may be eligible for a tax credit as. To claim a recovery rebate credit, taxpayers will need to reconcile their economic impact payment with any recovery rebate credit amount for which they are. Economic impact payments (eips) are considered advanced payments against a new credit, called the recovery rebate credit (rrc), that can be claimed.

Beginning in 2033, the maximum percentage of your. Generally, you are eligible to claim the recovery rebate credit if: Were no longer claimed as a dependent in 2020: