Fabulous Info About How To Manage Exchange Rate Risk

Looking for ways to mitigate foreign exchange risk?

How to manage exchange rate risk. Foreign exchange risk is the chance that a company will lose money on international trade because of currency fluctuations. 07 june 2023 by national bank. This useful guide by toptal finance expert paul ainsworth draws on 30+ years of experience as a cfo of large.

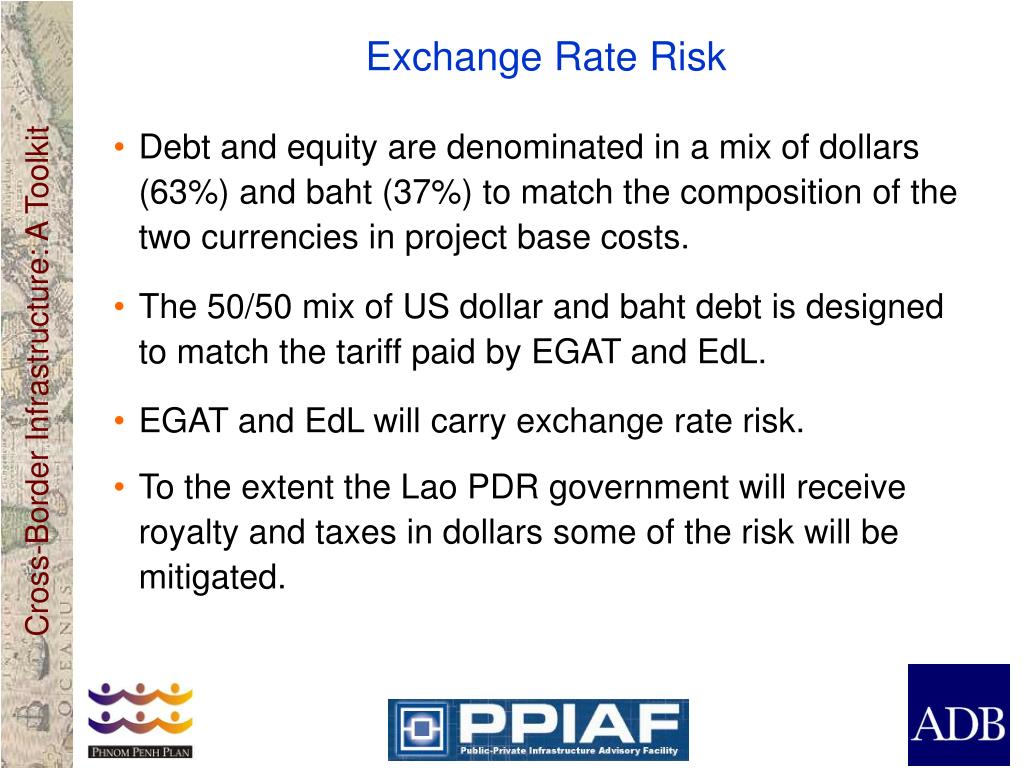

Exchange rate risk, or foreign exchange (forex)risk, is an unavoidable risk of foreign investment, but it can be mitigated considerably through hedging techniques. Exchange rate risk. However, exchange rate risk can be mitigated with.

This will help you determine your profit margin’s sensitivity to currency. How to manage foreign exchange risks. What is foreign exchange risk?

This article will run through some. Fluctuating currency prices can also cause market volatility which creates risk. When the value of a currency changes, it affects the.

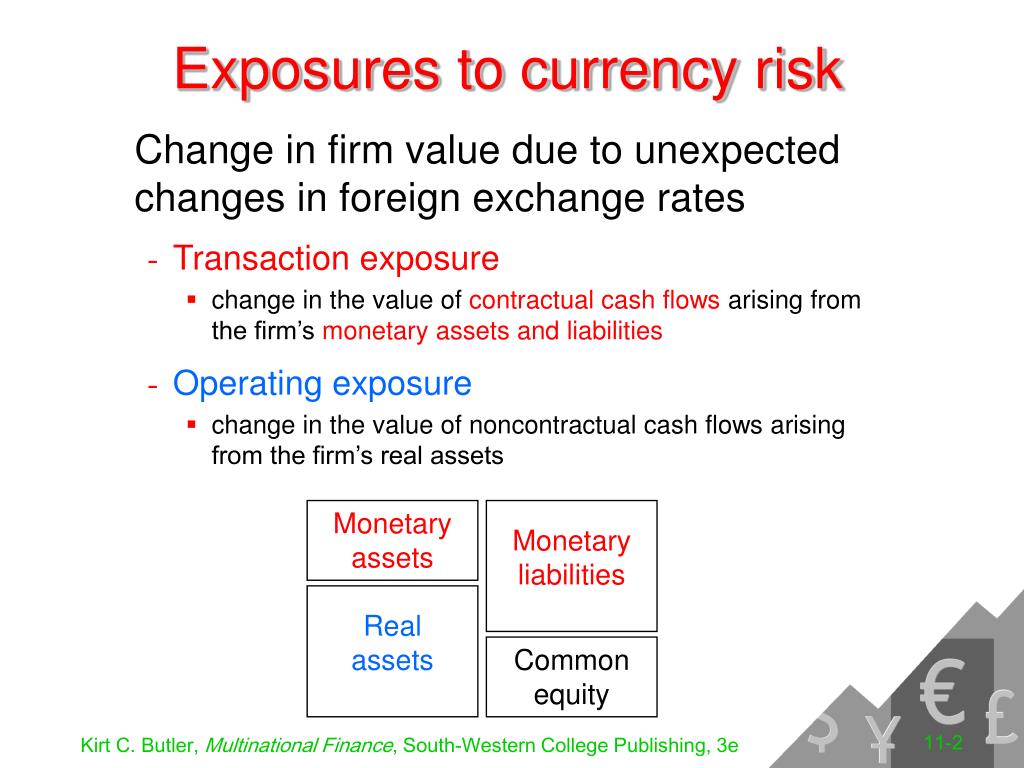

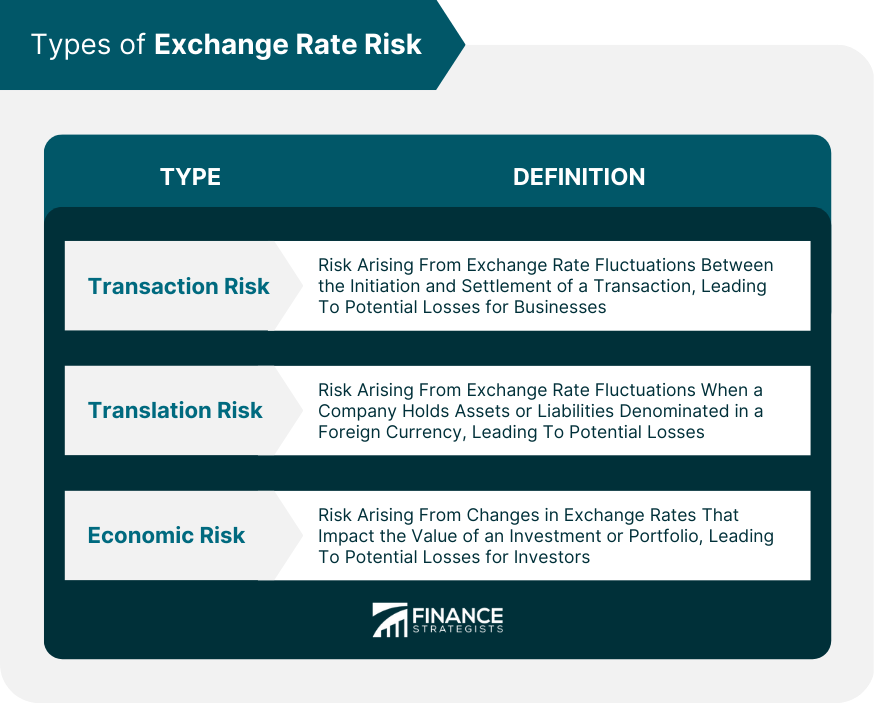

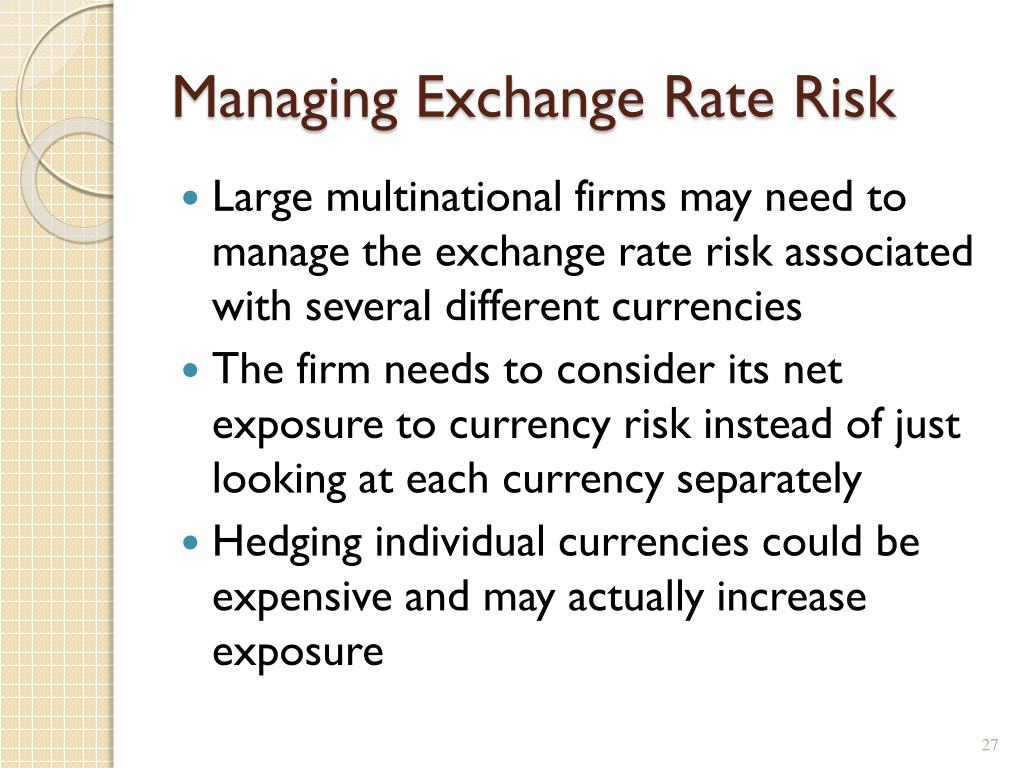

The main types of exchange rate risk. Measuring and managing exchange rate risk exposure is important for reducing a firm's vulnerabilities from major exchange rate movements, which could. A company that does business in a foreign currency is.

Foreign exchange risk refers to the losses that an international financial transaction may incur due to currency fluctuations. To eliminate forex risk, an investor would have to avoid investing in overseas assets altogether. Read on as we’ll take a deep dive into foreign exchange risk management and mitigation strategies.

It provides an overview of the key considerations that. Agf trades on the toronto stock. Review your business operating cycle to learn where fx risk exists.

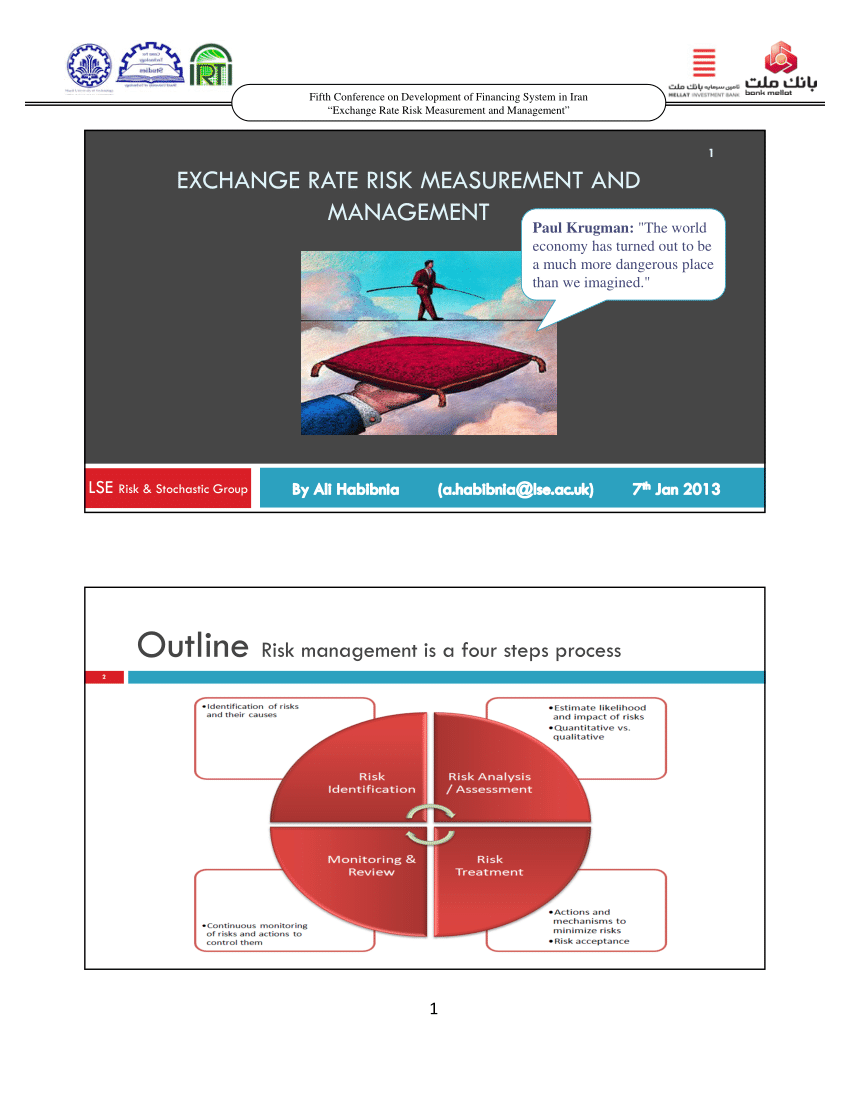

Types of forex risks for global businesses. This guide is intended to help cfos understand how to effectively manage currency exchange rate risks. A guide to managing foreign exchange risk.

In section iii, we review the main elements of. Foreign exchange risk refers to the risk that a business’ financial performance or financial position will be affected by changes in the exchange rates between. Currency exchange is the risk that future movements in exchange rates will have a material adverse impact on the position of your business.

Strategies for managing exchange rate risk: In section ii, we outline the main measurement approach to exchange rate risk (var). This calculation relies on three parameters: